An Effective Method to Improve Your Cash Conversion Cycle

By all accounts, income is one of the key presentation markers organisations ought to be generally worried about. Income just shows part of the image. An effective method to improve your cash conversion cycle helps in deciding the type of large business wellbeing, showing how rapidly an organisation can change over labor and products into cash.

In this article, we'll address these inquiries:

- For what reason does your cash conversion cycle matter?

- What's the distinction between the cash conversion cycle and the operating cycle?

- How would you compute your cash conversion cycle?

- What does a positive CCC say about your business?

- What are some monetary procedures for improving your income and CCC?

By the end of this article, you would feel significantly more sure about working with this basic monetary idea for your small businesses.

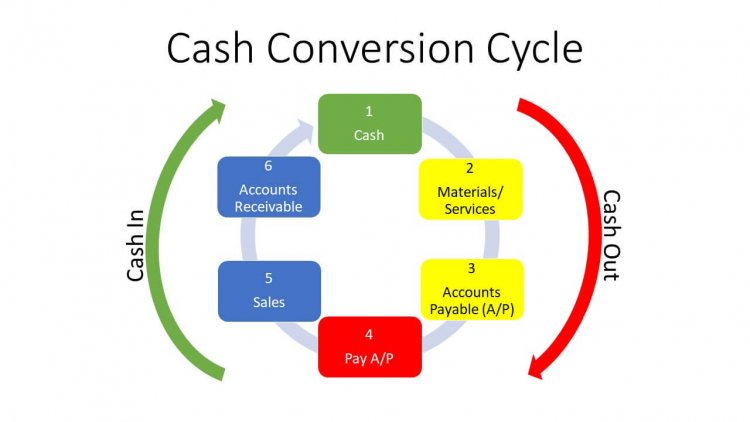

1. Cash Conversion Cycle (CCC)

Basically, your CCC is the time it takes to change over assets, like interest investments, and deals, into incomes. In an ideal world, this cycle ought to be just about as short as could really be expected (45 days is a decent benchmark) so your cash isn't tied up in stock or records receivable for a really long time bringing about income issues. Numerous things sway the length of the CCC. For instance, organisations that have longer installment terms with their providers will have a more limited CCC since cash doesn't need to be paid out as quickly. On the off chance that you stretch out exchange credit terms to your clients, your CCC will be reached out since they have longer to pay you. Moderate deals and financial plunges can likewise build your CCC.

The formula to calculate CCC is,

(Days Deals in Stock) + (Days Deals in Receivables) - (Days Payables Outstanding)

3. Calculating CCC

Calculating your business' CCC is a significant exercise that upholds any income investigation and is a necessary pointer of how your organisation is dealing with its functioning capital. To compute your CCC, you'll need to assemble information from your budget reports.

- Income and cost of products sold.

- Stock toward the start and end of the quarter.

- Records receivable and payable toward the start and end of the quarter.

- The number of days in the period to be determined.

4. Business with positive CCC

A positive CCC gives a few positive signs about your business, so in the event that you have one, congrats. For instance, a positive CCC can mean:

You're sharp about your stock. Organisations with a positive cash conversion cycle move stock rapidly. You settle on wise choices with regards to client requests and turn rapidly with changes in client taste. You gather what you're owed. Your organisation is the first-rate with regards to gathering records of sales. Possibly you even give motivating forces to get your customers to pay on schedule. When a receipt goes past due, it gets more costly and tedious to pursue the cash down. You pay sellers capably. A positive CCC demonstrates that you pay your merchants on schedule, however, augment the time it takes to move installment. Having accessible money is significant. Banks contemplate income when settling on choices in regards to an organisation's financing costs and advance sum. A positive cash conversion cycle shows moneylenders gather the majority of your benefits.

5. Monetary measures

Improving your CCC includes various general income executive strategies. This incorporates searching for approaches to move stock quicker, amplifying the measure of time it takes to pay your providers, facilitating the records receivable interaction, and, obviously, decreasing costs and improving incomes where conceivable. It's additionally essential to consider the monetary systems accessible to you that can help cure a portion of the reasons for long money change cycles and income issues, for example, the difficulties of expanding exchange acknowledge and managing for late-paying clients. On the off chance that you find that your CCC isn't just about as sound as it ought to be, survey your functioning capital financing choices so you can keep your business rolling while you address the hidden issues with your CCC.

Mr.Biller Team

Mr.Biller Team