5 Best Advice From ''Warren Buffett''

At 90 years of age, Warren Buffett has a total assets of more than $100.6 billion, making him the world's seventh-most richest individual. As an investor, philanthropist, and administrator, and President of Berkshire Hathaway, he is viewed as quite possibly the greatest investor on the planet. Here are the 5 best advice from Warren Buffett.

Warren Buffett is perhaps the best investor in history, and is generally viewed as the "Oracle of Omaha."

Buffett shares a lot of different bits of knowledge during investor gatherings and in his share meetings with investors. Warren Buffett is so straightforward in investing his thoughts and the way of thinking. While over the long haul he has tossed out a huge load of various goodies on investing, Rather than searching for simple additions or convenient solutions, be set up to invest the effort it takes. Beneficial things set aside some effort to plant, develop and prosper. He additionally states Don't utilise others' sentiments as a measurement for what you ought to or shouldn't do. Others' conclusions shouldn't be a factor in your dynamic interaction. Assess your choices and settle on choices dependent on information and strong thinking. here are the best five investing tips Warren Buffett has given:

1. Money Is The Ruler

Money is no joke to Warren Buffett, and he keeps a great deal of it available at the time. In Warren Buffett's words, he keeps a great deal of money close by "so we can both withstand uncommon misfortunes and rapidly take advantage of securing or speculating lucky opportunities." This is strong guidance for individual budgets. You generally need to keep a secret stash for the unforeseen, however, you ought to likewise keep cash in your money market fund all set so you can purchase things on the plunge.

2. Dividends Are Your Companion

Buffett loves dividends, as do most esteem investors do. Dividends are an incredible advantage to purchasing an organisation, as it typically shows that the organisation's funds are fit as a fiddle to help to pay out its well-deserved cash. Buffett likes organisations that have a long history of delivering profits and surprisingly expanding them over the long run.

3. Invest in Undervalued Stocks

Buffett is a hotshot investor and consistently hopes to purchase undervalued stocks dependent on their inborn worth. He computes the characteristic worth by taking a look at the organisation's essentials at least throughout the most recent five years, at times longer. He looks a ton at the profit from value, working edges, and having practically no obligation. He compares the organisation to his peer group and likes to check whether it is undervalued or not. An essential piece of this is to search for organisation's that have some sort of syndication or an extraordinary quality that will empower them to be fruitful later on.

4. Buy and Hold

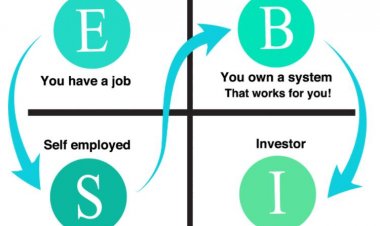

A true Buy and Hold investor is Warren Buffet. He stands firm on his footings for an extensive stretch of time and continually emphasises this to his adherents. Indeed, he has said to "Buy and Hold for eternity." And it is valid since he has possessed a large number of his positions for more than 20 years, which is ages in the contributing scene. Nonetheless, he has additionally said that this doesn't mean hold an organisation if the essentials have changed. Discover organisations you like, and hang tight at the right cost. It has been said that Buffett has a rundown of many organisations that he needs to put resources into, however, that he is sitting tight for the right cost and opportunity.

5. Patience is The Key

Buffett is regularly cited as saying: ''If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes." Buy and hold is a venture methodology Buffett depends on for long-haul monetary development. "Useful resources like real estates, farms, and, indeed, business possession produce a lot of abundances. Most proprietors of such properties will be remunerated. All that is required is the progression of time, an internal quietness, and minimisation of exchanges and charges.

A few of his best quotes are,

“I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

“In the business world, the rearview mirror is always clearer than the windshield.”

Mr.Biller Team

Mr.Biller Team