6 Moral lessons from'' Rich Dad, Poor Dad''.

Here are 6 simple financial lessons from the book that will help you create wealth in comfort and retire.

Monitor your money

Many individuals can make money, but not everyone knows how to efficiently invest it. Financial wisdom begins with the disparity between assets and liabilities being taught. You will become aware of your spending habits and ensuring that you have more money coming in than going out by maximizing your investments and monitoring your expenses, which is what would make you wealthier. Many people make the mistake of assuming that earning more cash would fix their financial woes, but if your outgoings still rise exponentially, this will only help to compound them.

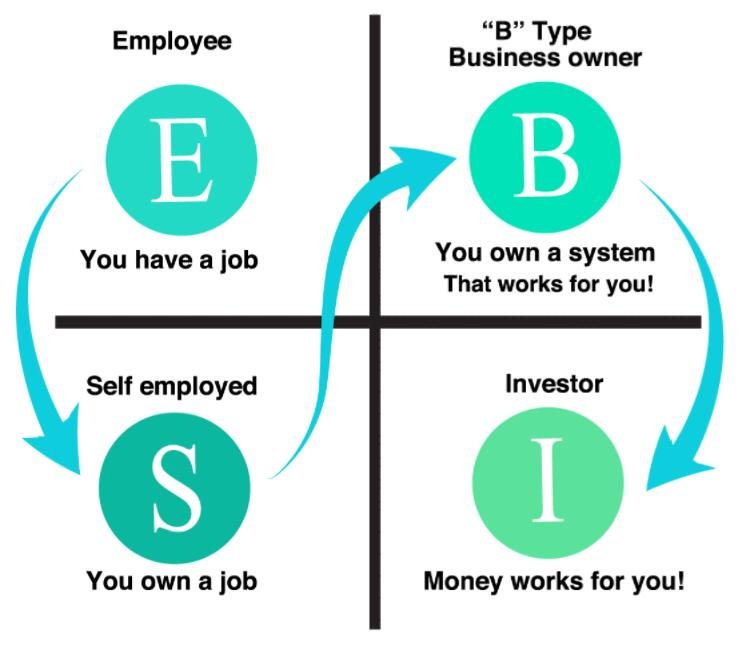

Make money work

Kiyosaki's strongest point is that the lower and middle classes struggle for their money, while the rich have money to work for them. Study how money works, and, regardless of a salary, figure out how to make more. Look at how more revenue can be generated by wisely spending your capital. Don't grant your boss financial leverage, but instead maintain the power by getting care of your resources and making it work for you.

Be bold and do not be afraid to lose

Many individuals cannot win because they're terrified of losing or failing. However, by making errors, we also learn and improve, and failure is often part of the process of becoming efficient. To have financial success, you do not have to be ridiculously intelligent. Often, creating wealth means taking chances and coping with a degree of confusion. By being smart and drawing about your experiences to analyze a situation, rather than jumping blindly. To minimize your risk and optimize your benefit, the road to prosperity always needs you to leverage money.

To become financially smart and literate

Ignorance is the main source of financial trouble since this is not learned in certain school programmes or communities. Financial jargon can be confusing and overwhelming, but through reading about accounting and investing, and staying updated about the markets, you can gain financial knowledge. Courage is going to take you far, plus technological skills.

Train your mind for opportunities

Look for innovative solutions to many problems with capital. Opportunities don't fall from the sky, leverage your options and figure out what you can do to boost your financial status. Think of various financing options that you can turn things into possibilities.

Concentrate on investments over profits

Instead of the monthly wage, focus on your net worth. First, build your asset column, then purchase some luxuries with the revenue generated from them. By the number of days you can live off the gain from your assets, you can calculate your income. And if your monthly revenue from your investments increases monthly expenses, you should declare yourself financially independent. Making money is a matter of mentality. Make sure you know how it operates, and do not wait to hold a meeting if you need any assistance in adapting these ideals to financial independence.

Mr.Biller Team

Mr.Biller Team